The Legislative Newsletter of the Missouri State Teachers Association

MSTA Action:

March 28, 2024

In this week's Action:

- House committee hears SB727

- Pension bills continues to advance

- Student behavior infographic

- Bill Summaries

Question of the week: What student behaviors do you wish your administration would address in a more direct and serious manner?

Senate Bill 727 Omnibus Bill Heard in Special Committee on Education Reform

The House Special Committee on Education Reform held a hearing on SB727 (Koenig), the voucher expansion bill that ballooned from 12 pages to over 160 pages on the floor of the Senate two weeks ago. The current version of the legislation includes vital teacher recruitment and retention provisions including a raise in statute for the minimum teacher salary and the minimum masters plus 10 provision. 397 districts across the state have a master’s plus 10 minimum under $48,000. In total the bill would cost an additional $50 million for the voucher scheme while providing over $400 million to support public education when fully implemented in 2031.

The bill includes provisions for several MSTA priorities this session:

- Increasing the minimum teacher’s salary from $25,000 to $40,000. For teachers with a master's degree and at least ten years of experience, this act increases the minimum salary from $33,000 to $46,000 for the 2025-26 school year then up to $48,000 in the 2027-2028 school year then increases both minimums by the rate of inflation. The bill creates the Teacher Baseline Salary Grant Fund and Teacher Baseline Salary Grant Program for the purpose of providing state funds to pay for both the minimum and the master’s minimum.

- Changes to the Career Ladder program, repealing a provision of current law that requires Career Ladder responsibilities and career efforts to occur outside of compensated hours. The bill adds serving as a mentor for teachers to the list of activities for which teachers may receive Career Ladder admission and stage achievement. The two-year Missouri public school requirement would be removed for any member of the Armed Forces or such member's spouse who has teaching experience in another state and who has transferred to this state.

- Work after retirement penalty changes, eliminating the punitive punishment for going over the work limits placed on retirees. The proposed language would enable retirees, including those retired due to disability, to receive up to half of the annual compensation specified in the employer's salary schedule for the retiree's former position, considering their experience and education, or 50% of the limit set by the local school board for the position. The work after retirement limits would still be in place but would allow individuals to pay any earnings over the limits back to the system, instead of relinquishing their entire monthly benefit.

- An increase of the Small Schools Grant appropriation from $15 million to $30 million.

- Changes to the Weighted Average Daily Attendance, as used in the education funding formula, by allowing half of the calculation to be based on student enrollment - not solely on student attendance, increasing funding for public education.

- Creation of the Teacher Recruitment and Retention State Scholarship Program, which would provide scholarship funds to cover up to 100% of the tuition costs related to teacher preparation at a four-year college or university located in Missouri. A maximum of 200 students may qualify for the scholarship, which would be funded with $1.2 million in the first year. This amount will grow to $3.4 million and fund up to 600 scholarships, in the 2030-31 academic year. Scholarship recipients after June 30, 2025, shall sign a statement that they have made a good faith effort to secure all available federal sources of grant funding.

- Expansion of funding for early childhood education programs.

The bill also contains many provisions that MSTA opposes:

- The underlying bill would immediately expand the current voucher program with minimal additional transparency or accountability in the program, removing the geographic restrictions that currently exist. The maximum amount of tax credits that may be allocated in any year would expand from $50 million to $75 million, allowing the tax credit program to continue growth. The maximum amount would then progress annually by any percentage increase or decrease in the amount appropriated to school districts under the foundation formula.

- The act modifies the definition of a "qualified school,” providing that FPE schools, rather than home schools, shall be qualified to participate in the program. It would also include any student who is a resident of Missouri, rather than only those students who live in a charter county or a city with at least 30,000 inhabitants, who is not unlawfully present in the United States or a person who gained illegal entry. Such definition is further modified to include any student who is a member of a household whose total annual income is 300% or less than the income standard used to qualify for free and reduced-price lunch, rather than only those students whose household income is 200% or less than such standard. Siblings of qualified students who received a scholarship in the previous year will receive a scholarship in the current year. (Section 166.700)

- DESE would develop a new teaching certificate for private school teachers, not to be used in public education. The Department must develop an 18-hour online teacher preparation program related to subjects appropriate for teachers in different content areas determined by the Department. An individual with a bachelor's degree may complete the online training program and receive a certificate of license to teach. Such certificate shall not be accepted by Missouri public schools but shall be accepted by private schools and private school accrediting agencies.

- Restrictions would be placed on a locally elected school board’s ability to set their own calendar, beginning in the 2026-27 school year. The bill would require that school districts located wholly or partially in charter counties or cities with more than 30,000 inhabitants may adopt a four-day school week only upon a majority vote of the qualified voters of the school district. School districts with a five-day school week would receive an additional appropriation amount equal to 1% for fiscal years 2026 and 2027, or 2% for fiscal year 2028 and all subsequent fiscal years, of the district's preceding year's annual state aid. Funds received pursuant to this provision must be used by school districts and charter schools exclusively to increase teacher salaries.

- Charter schools would be allowed to expand and operate in Boone County under current charter school rules and regulations without additional local control protections.

- Other provisions in the bill include the funding of grants to school districts and charter schools for home reading programs for children in kindergarten to 5th grade, changes to the payments virtual school program and the creation of a new classification of school. This would mirror home schooling but would be called “Family Paced Education” and would be allowed to participate in the state voucher program.

SB727 contains many items, not only those that MSTA has identified as priorities, but also potentially harmful changes we have fought against for years. This is not how MSTA would have crafted the bill, and we hope it will be changed to remove harmful provisions. Sections of the bill which increase teacher salaries, increase foundation formula funding and double the small schools grant are vital to addressing teacher recruitment and retention efforts.

Pension Bills Continue to Move Through Process

The House Pensions Committee held a hearing on HB2906 (Steinhoff), which would allow PSRS/PEERS system retirees to retain their monthly benefit with a proportional penalty if they were to go over the work after retirement limit. Currently, retirement system members who surpass the work after retirement limitations are ineligible to receive their entire monthly pension for any month in which they exceed said limit. This legislation is identical to SB1286 (Bernskoetter). It would enable retirees, including those retired due to disability, to receive up to half of the annual compensation specified in the employer's salary schedule for the retiree's former position, considering their experience and education, or 50% of the limit set by the local school board for the position. The work after retirement limits would still be in place under the bill but would allow individuals to pay back to the system any earnings over the limits instead of relinquishing their monthly benefit. This change would result in no cost to the retirement system and would eliminate the drastic penalty to system members that may miscalculate their work time/ earnings or get inaccurate/late data from districts. MSTA testified in support of HB2906 (Steinhoff). This cost-neutral change to work after retirement would benefit both current and retired members of the PSRS/PEERS systems.

The House Pensions Committee voted do pass on HB1722 (Crossley). This states that when a school district has declared a shortage of noncertificated employees, it may employ a retired noncertificated employee for up to four years without affecting his or her retirement benefit. Currently, there is a cap of the lesser of 10% of noncertificated staff or five employees is in place. This bill changes the cap to the greater of 1% of the total of certificated teachers and noncertificated staff or five employees. This would align critical shortage limits for both certified and non-certified positions as this change was made regarding PSRS positions last session. All requirements for filling positions under the critical shortage provision would remain in place.

The Senate Committee on Veterans, Military Affairs and Pensions committee voted do pass on SB877 (Beck), which would allow for a 2.6% multiplier factor for retirees with 33 or more years of service.

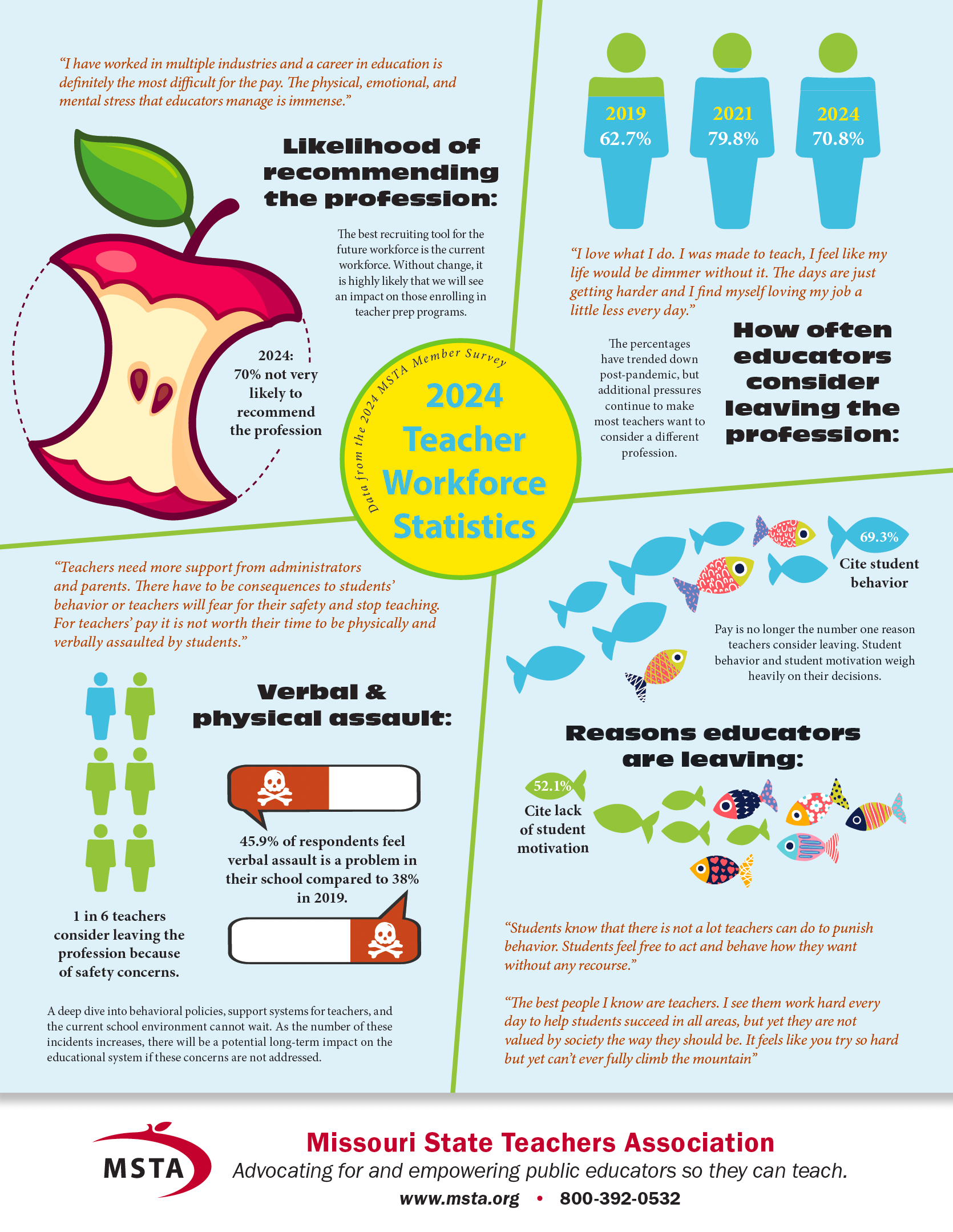

Survey Results Infographic

MSTA created an infographic to explain the results of the recent MSTA 2024 Teacher workforce survey and how they impact the teaching profession. Please share this information with your elected officials, fellow educators, friends and community. Download a printable pdf.

Bill Summaries

House

Special Committee on Innovation and Technology

HB1688 (Reedy) requires the State Board of Education to develop a driver education instruction and training program to be offered as part of the health curriculum in public and charter schools to pupils in grades 10 to 12.

Special Committee on Education Reform

HB2937 (Davidson) establishes the Student Opportunity Savings Accounts Program. The purpose of the program is to provide direct payments to eligible pupils for qualified expenses at an approved education entity as outlined in the bill.

Senate

Select Committee on Empowering Missouri Parents and Children

SB1164 (Black) creates the Education Stabilization Fund in the state treasury to create an emergency fund for public education. The Governor may transfer from the Education Stabilization Fund to the foundation formula to ensure schools are funded as closely to the fully appropriated amount as practicable.

SB1290 (Carter) establishes the Classical Education Grant Program and corresponding fund in the state treasury for the purpose of assisting school districts with providing programs in classical education.

MSTA in the News

MSTA survey sheds light on why teachers consider leaving - Jefferson City News Tribune

Missouri teacher survey shows high number of teachers have considered leaving profession - WGEM

Missouri teachers share concerns regarding safety, low pay & stress in new survey - KY3

Impact of 4-day school week: benefits, challenges rise in Missouri

More Education Policy Information